Things are about to get scary this Halloween season, and we aren’t just talking about the haunted houses, spooky stories, or stomachaches from eating too much leftover trick-or-treat candy. We are talking about the frightening clients who sweep in and, like a powerful gust of October wind, leave a mess in their wake. Bad clients are not only tough to work with, they can also be incredibly costly to your business.

These clients are expensive because they steal your time, profits, and, in some cases, your sanity. Everyone has their flaws, but clients who are continuously difficult to work with can turn your work into a real nightmare. This Halloween season, we discuss three types of “spooky” clients to avoid in your firm.

Vampires

Vampires are the clients who suck your energy and time. They need to know what is going on at all times and get upset if they aren’t constantly in the loop. Of course, they know you have many other clients but somehow still expect you to give their questions and problems the top priority. Vampires can be draining and distract you from serving your other clients or further growing your practice.

Ghosts

Ghost clients are the opposite of vampires. After you initially agree to work with them, they all but fade from view. When you try to contact them, they are nearly impossible to get ahold of. Ghosts feel like their lives are more busy than the rest of the world and expect you, as their accountant, to work around their schedule. As a result, they wait until the last minute to provide you with the paperwork and important information that is necessary to fulfill your job.

Often, what they eventually do send your way is missing crucial material, such as a receipt, wage statement, recent tax return, etc. But, of course, when you ask for these things, the process starts all over again. Finally, when you have all the information to effectively do their work, they call shortly after asking what is taking you so long.

Skeletons

Skeletons in the closet are harmless...until they are discovered. These clients seem ordinary at first, but the more you interact with them, the more you realize that they are keeping things from you. Eventually, you discover that they haven't always been completely truthful in their dealings with the IRS or previous accountants. Maybe they reported a little less income, exaggerated their charitable contributions, lied about how many dependents they have, or any number of other, more serious crimes.

The tricky part of working with these clients is that even if they claim to have changed, it is hard to trust them. Clients who have previously lied to their accountants, or the IRS, likely won’t always be honest with you. This dishonesty can create complications that reflect negatively on you as their provider.

Celebrating Halloween this season may add a few frightening expenses, but bad clients don't have to be one of them. Take advantage of the time after the October tax deadline to determine which of your clients are benefiting your business and which are dragging it down. Save your time, profits, energy, and sanity by focusing on clients who allow you to have a spooktacular business.

To find out how to let these clients go, check out our article "How to Fire a Client: A Guide for Who to Keep & Who to Let Go."

Do you have any of these spooky clients at your firm? Let us know in the comments below.

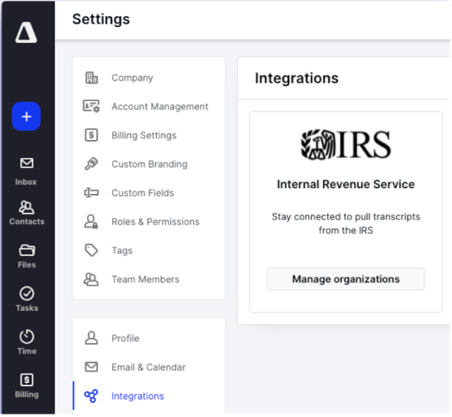

Canopy is a one-stop-shop for all of your accounting firm's needs. Sign up free to see how our full suite of services can help you today.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.