So you decided to take the leap and add tax resolution to your practice. Congratulations! You're well on your way to doubling your monthly income and discovering a new sense of job satisfaction. But now that you've made the decision, where do you go from here? What steps should you take to successfully integrate tax resolution services into your practice? Don't stress–the process isn't as complex as you might imagine.

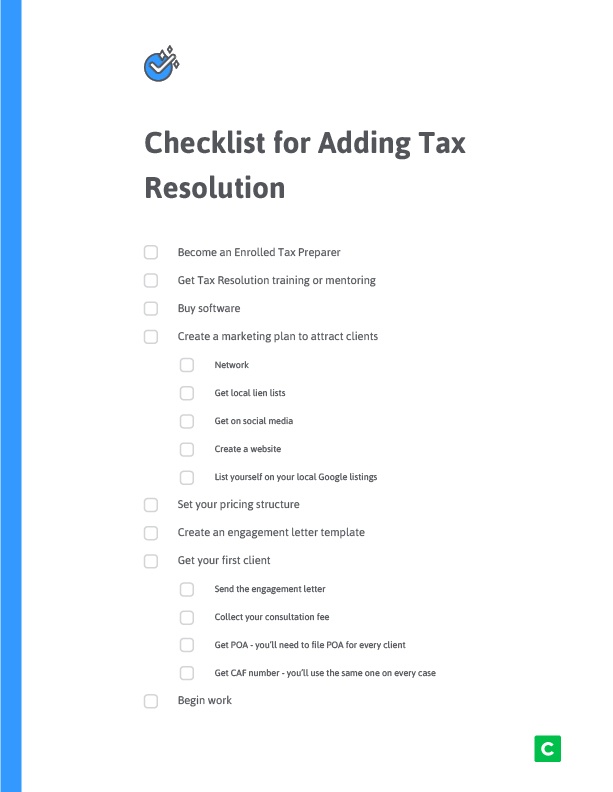

Adding tax resolution boils down to eight manageable steps, as shown in the checklist below. And to make your life a little easier, we've also included a downloadable version that you can print and keep right on your desk.

Step 1 – Become an Enrolled Agent. This means you have the legal right to represent your clients in tax disputes with the IRS.

Step 2 – Get trained. Find a mentor, attend a tax resolution conference, or watch a couple of webinars to learn the tricks of the trade before you dive in.

Step 3 – Choose a tax resolution software. Having a good cloud-based accounting software solution can save you hours per case by helping you keep all of your client information in one place. It can even double check your work so you don't have to.

Step 4 – Create a marketing plan. To attract clients, you'll need to get your name out there. Network with other CPAs in your area, get copies of local lien lists, update your practice's social media accounts and websites, and make sure you're listed on Google.

Step 5 – Set your pricing structure. Not sure how much to charge? Learn how to price your tax resolution services here.

Step 6 – Create an engagement letter template. No really, trust us. Having an engagement letter template you can reach for every time you secure a new client will save you hours down the road.

Step 7 – Get your first client. Congratulations! Now it's time to send the engagement letter, collect your consultation fee, and get started on case logistics like getting Power of Attorney and your CAF number.

Step 8 – Get to work. You're all set! But be prepared – you may find that you enjoy tax resolution work so much that you want to ditch tax prep for good.

Want more details on how to successfully add tax resolution to your practice? Download our free ebook below.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.