In order to start representing clients in tax disputes, you need to be certified as a CPA, an attorney, or an enrolled agent. Any of these certifications will allow you to work with the IRS on tax resolution cases. The next step, and the focus of this post, is getting Power of Attorney for each client you plan to represent.

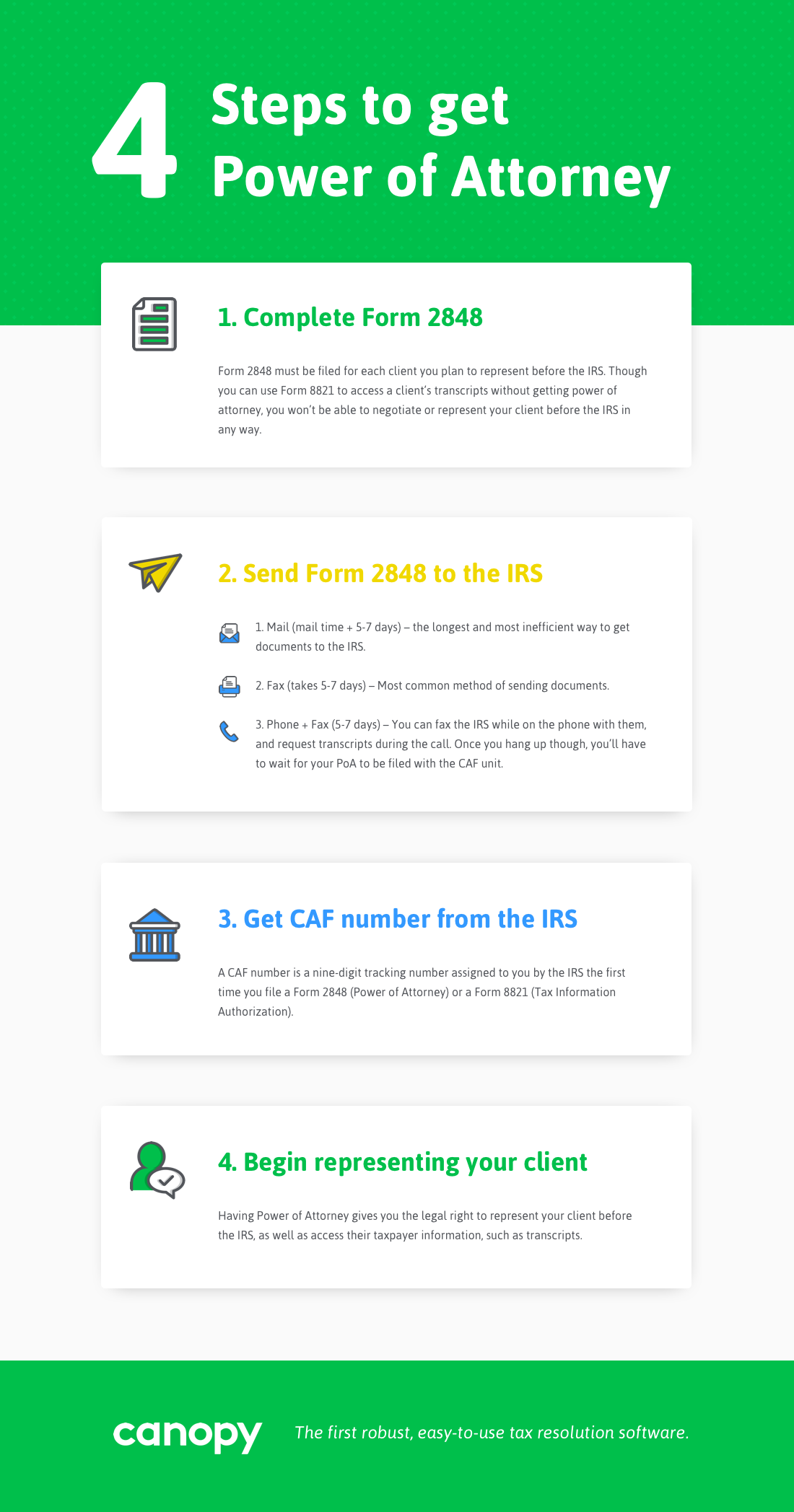

Getting Power of Attorney is a fairly straightforward process which boils down to four steps:

1. Complete Form 2848. Technically, you can use Form 8821 to access your client's transcripts without having Power of Attorney on file, but you won't be able to represent your client before the IRS in any way without Form 2848 on file.

2. Send your completed Form 2848 to the IRS. Depending on how much time you have, you can submit this form in several ways. First, you can mail it, which takes at least a week. Second, you can fax it, which takes 5-7 business days for processing. And lastly, you have the option of faxing your form while you're on the phone with an IRS agent. During the call, you can request transcripts to help you get started on the case, but you won't be able to represent your client with the IRS until the Power of Attorney request is processed.

3. Get your CAF number from the IRS. A CAF number is a nine-digit tracking number used by the IRS to process your document requests. You'll get your CAF number the first time you file Form 2848 and you'll use the same CAF number for every case thereafter.

4. Begin representing your client. Now that you have an accepted Form 2848 and you've received your CAF number, you're ready to start practicing. You can now represent your client in tax resolution cases, as well as request client information, such as transcripts.

As a tax resolution specialist, you'll encounter a variety of tax issues. Many of these may require you to submit offers in compromise to settle your clients' tax debt. And fortunately for you, you can become an offer in compromise master with our new ebook! Download it for free now.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.