Freelance workers or contract workers are growing in number each year. Companies who want skilled workers but may not need them full time as employees are fueling the demand for freelancers. In addition, the gig economy, or task-based employment, has made contract work more appealing than ever.

During tax season, every freelancer will face a number of unique challenges in filing their income tax returns. There are many different factors to consider when paying taxes as a freelance worker, and tax accountants can be a big help to their freelance clients.

What is a freelancer?

Freelancers are self-employed contract workers who engage in work for companies, usually on a task-based basis. Some of the most common freelance workers are drivers, writers, artists, computer programmers, virtual assistants, graphic designers, bookkeepers, tutors, and social media marketers. Some freelancers are full time, while others pick up side hustles for some extra money. It’s easier than ever for companies to locate flexible talent thanks to freelance websites, apps, and online classifieds.

According to the McKinsey Global Institute, between 20 and 30 percent of the working population in the United States is engaged in some form of freelance work, and that number is forecasted to increase faster than average in the coming decade. This means millions of people are going to need guidance on incorporating their freelance earnings into their income tax returns properly. The U.S. government has implemented different standards and allowances for freelance workers, and tax accountants can greatly assist their freelance clients in filing their income tax return.

Freelance works and income taxes

The IRS treats freelance workers differently for tax purposes than traditional employees. On the whole, freelance workers have more complicated tax returns than traditional employees. As self-employed workers, they must file taxes as if they were the owner of their own business. Other factors that may come into play for a freelance worker, such as business expenses, home offices, and more can turn straightforward income taxes into something more complex that requires the help of a tax accountant.

Tax accountants must try to convince freelance clients to hire them to assist with their taxes. Not only does it give freelancers some guidance on how best to manage their tax returns, it can help them prevent costly mistakes and create better plans for next year. Most freelance clients don’t realize how uninformed and uneducated they really are about the intricacies of income taxes as a contract worker. Tax accountants are in the perfect position to help them reduce their taxable income without shirking their tax obligations.

Key tax issues for freelance workers

Tax accountants can help their freelance clients understand the key tax issues that affect them the most. There are four specific areas that influence how a freelance worker’s tax return looks: Income, Expenses, Self-Employment taxes, and Quarterly taxes.

-3.png?width=600&name=Visual%202%20(2)-3.png)

Income

Freelancers must report every dollar of income they receive from their clients to the IRS. Formal contracts between the skilled worker and the company will result in a 1099 Form. The company reports the amount to the IRS and sends the form to the freelancer. The form shows the money paid out and reflects the fact that nothing was taken out, such as social security or federal taxes.

Not all freelance workers will get a 1099 Form from their clients. In this case, the freelancer must consult their own bookkeeping records for an annual total. They still need to report that income to ensure that an accurate income total appears on their tax return.

Expenses

The IRS allows freelancers to claim certain business-related expenses to reduce their tax liability. There are many freelance deductions that contribute to being a successful, self-employed contract worker and some of the most common include:

- Office supplies

- Travel, such as mileage and meals

- Advertising expenses

- Computer equipment

- Home office expenses

- Cell phone service

Every freelancer who plans on using expenses for deductions must keep excellent records, usually in the form of original receipts and invoices, to prove that their claims are true and accurate. Improper or unusual claims may raise a red flag with IRS auditors, so it’s important that freelancers get it right. Tax accountants can help guide freelancers in determining what expenses are worth claiming on a tax return.

Self-Employment Taxes

Freelancers like getting large paychecks because no taxes have been taken out by an employer. However, this leaves the burden of setting aside taxes to them alone. It’s a good habit for freelance workers to set aside money from every paycheck in anticipation of their tax bill. Tax accountants can help them estimate what their tax burden will be, then guide them in withholding. Some freelance workers even set up a separate bank account for their taxes so that when it’s time to file, they aren’t financially struggling to come up with funds.

Quarterly Taxes

In general, the IRS expects anyone that works as a contract worker to pay their estimated taxes via a quarterly schedule instead of as an end-of-year payment. This is generally true for any freelancer that will likely owe more than $1,000. Because freelancers are responsible for paying all the payroll taxes, it is usually wise for them to expect that they will have to pay quarterly.

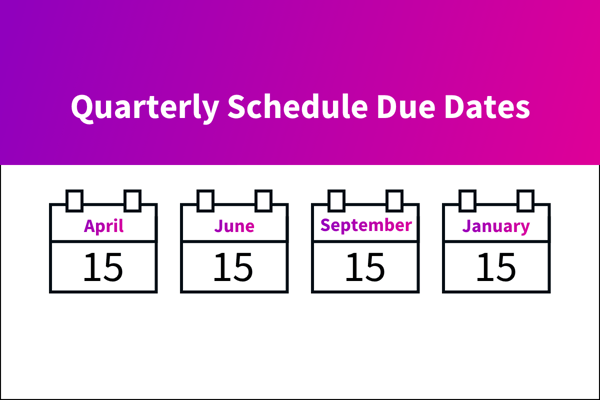

Tax accountants can help freelancers estimate how much tax they will owe each quarter so that they are not overpaying or underpaying. The due dates on the quarterly schedule set up by the IRS are April 15, June 15, September 15 and January 15. Freelance workers that miss these deadlines to file for quarterly taxes may be penalized with a fee.

Tax accountants really benefit freelance workers

There’s nothing simple about income taxes for freelancers, but the good news is that a qualified tax accountant can make things go more smoothly. By helping freelance clients navigate the present and future needs of their own business, they will be able to guide them in keeping accurate records, withholding proper funds, minimizing red flags for auditors and maximizing their profits.

With so many freelance workers in this country operating full or part time, there are plenty of potential clients out there for tax accountants who are willing to help them navigate the intricacies of running their own business and finding success.

Want to read more about working with clients who freelance? Check out 5 Reasons You Should Market Your Tax Resolution Services to Freelancers.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.