Tax resolution has never been simple. From individuals filing incomplete or incorrect tax returns to company-wide audits, situations vary and require an immense amount of time from tax resolution experts.

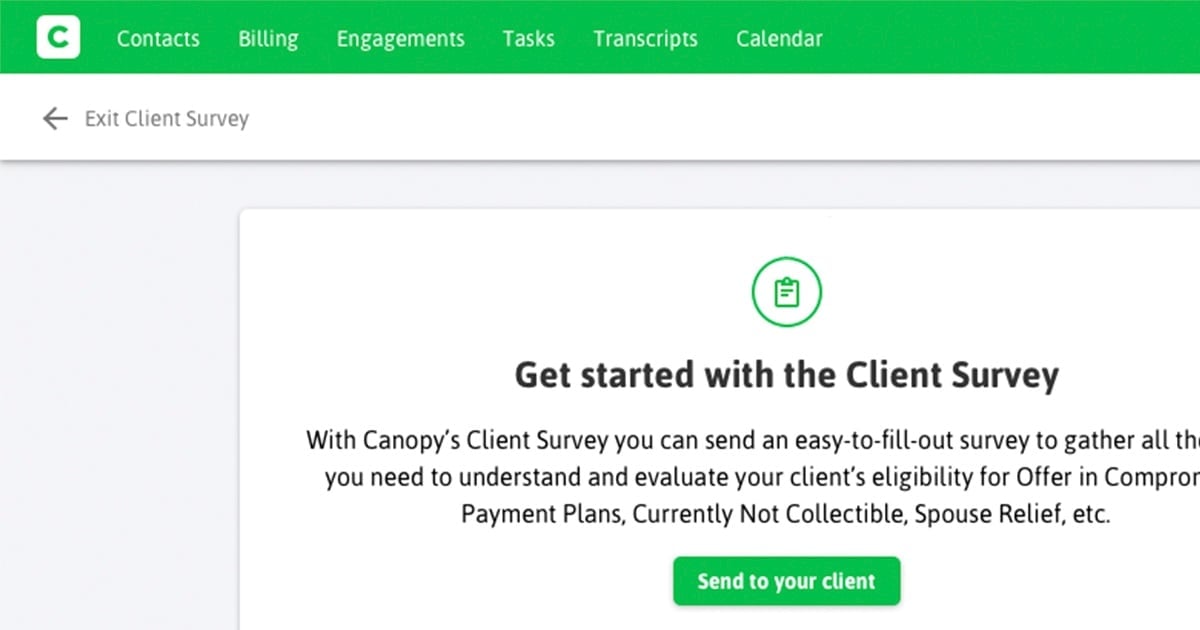

Collecting client information is often one of the initial steps a tax practitioner must take before the tax resolution process is underway. For many years, accountants and tax professionals have been working with paper tax forms. Canopy is transforming the tax resolution workflow by introducing the Canopy client survey.

Why have your clients manually write their information on paper forms when you can send a quick client survey and have them enter the information online? Accountants are saving 1-3 hours per case by having clients fill out the online Canopy survey. That's 1-3 hours back to you and your tax practice!

Here are a few more reasons our client survey will transform the tax resolution workflow:

1. The Canopy client survey is simple and clear.

All you have to do is sign into the Canopy platform and create a new engagement. From there, Canopy has a built in survey that you can send directly to your client's email address. The client survey platform signals which information the client needs to fill out and questions they need to answer. The survey has complete coverage of both Form 433-A and 433-B.

2. Clients enjoy filling out the online client survey.

Clients actually prefer filling out the online client survey versus the old "pen and paper" way. The Canopy client survey is less intimidating than paper IRS forms. It’s intuitive and only asks the client relevant questions based on their previous answers. (For example - the survey may ask if the client owns a house. If the client's answer is "no," the survey will not ask the client further questions about housing, etc.) Canopy has even built in helpful hints throughout the survey to ensure that the clients are providing accurate and relevant information. This saves you time since your clients won't be asking you as many questions about how to fill out the tax form. Questions and terms that are typically confusing to clients are defined for the client (terms like the IRS standards for food expenses, what does real property mean, etc).

3. It automates the tax resolution workflow.

After your client has entered in all the requested information into the client survey, the information is stored and auto-populated into every necessary form. Yes, that's right - AUTO-POPULATED. Meaning you don't have to re-enter any client information!

4. You can share the information with select colleagues.

You can share the client information with other tax practitioners or enrolled agents at your practice. No longer do you need to attach forms to emails, create separate documents, and crunch data. The Canopy software was designed with teamwork and collaboration in mind.

5. The Canopy platform is secure.

You no longer have to invest in internal IT teams or expensive hardware to protect your data. The Canopy platform is a cloud-based application - meaning that highly protected and specialized data centers are safeguarding the information at all time. Data center providers employ the latest technology and highest amount of security.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.