Cloud computing is the process of delivering hosted services using the internet. In a short time, cloud computing has emerged as an efficient and advanced way to boost the success of just about every type of business. Accounting firms are not alone in harnessing this practice and many are seeing tremendous savings in time and money.

If your accounting firm isn’t already taking advantage of using the cloud, there’s no better time to start.

What is the cloud?

If you are not familiar with exactly how it works, the cloud can seem mysterious. Many business owners are surprised to discover that the concept of the cloud is straightforward, and more business owners are embracing the clear advantages and incorporating cloud services into their companies.

Cloud computing harnesses the power of the internet to perform tasks that are usually done on a desktop computer. The cloud can run applications and software programs via the internet. The clear advantage of cloud computing is that it allows you to access an enormous storage capacity of hundreds of hard drives, making them accessible from anywhere on any device. Whether you are next door or across the country, data and documents are at your fingertips. It’s easy for businesses large and small to get on board.

What are the benefits of cloud computing?

Studies show that more businesses than ever are using cloud computing technology. Consider the following:

-

-

- 90% of all companies are using cloud computing.

-

-

-

- When asked, most businesses choose to use cloud services because it allows them to access data anytime and anywhere.

-

Accountants who use the cloud are not only syncing their firms with the latest technology, they are overcoming a lot of challenges that would have held them back from progressing. From saving time and money to boosting productivity and maximizing client interactions, there’s no doubt that cloud computing is a necessity for your modern accounting firm.

Here are just a few of the benefits that accountants can discover when using the cloud:

Saves time

One way using the cloud could save you time is that it allows for and promotes collaboration. Any number of your staff can use the cloud at the same time and be working on the same documents. With cloud computing, you don’t have to wait for one person to be finished with a task to start your own—you can simultaneously complete tasks and help clients.

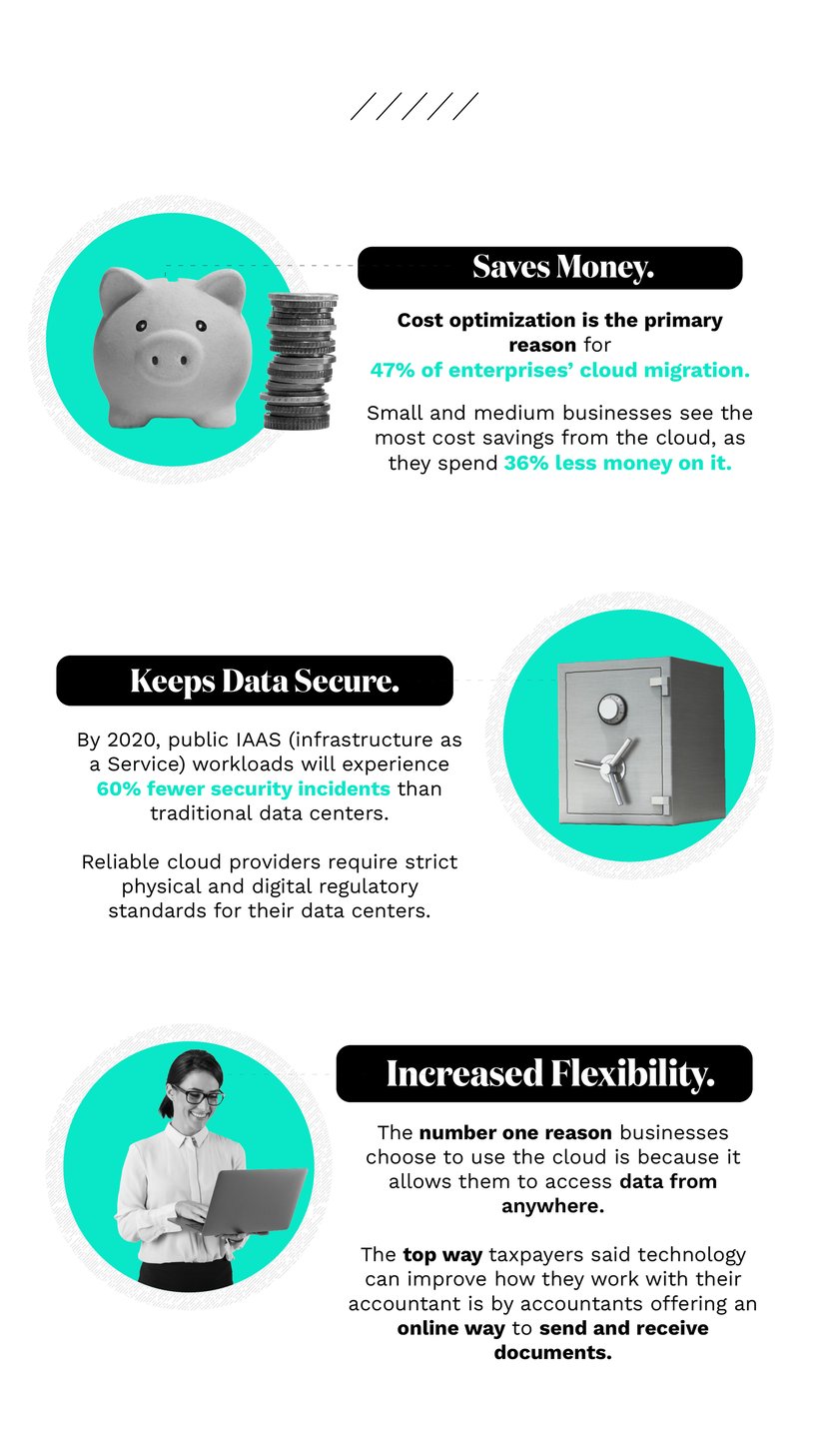

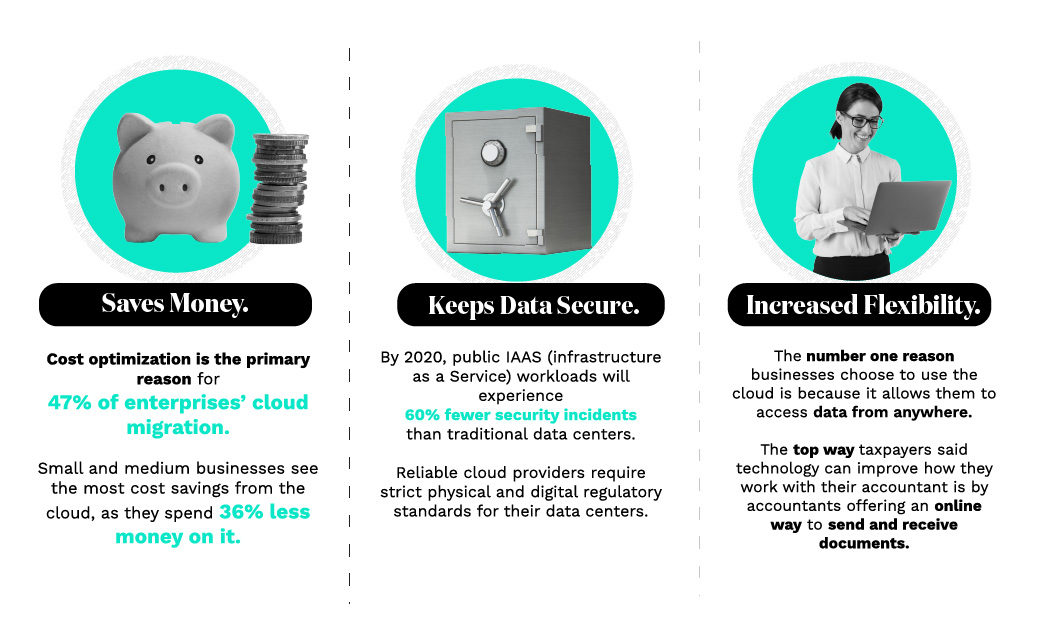

Saves money

Using cloud-based applications and software for things like client management and document management allows you to access exponentially more storage and functionality for a lower price than buying multiple hard drives or purchasing several types of software.

Great value for the cost

Rather than buying different software for different functions, many cloud applications offer several different accounting functions in the same place. Cloud applications also update periodically, so you don’t have to worry about downloading updates. Modern technology companies are committed to innovation, and you can expect new features in your cloud-based system multiple times a year, without any additional cost.

Keeps data secure

Because data is stored on multiple remote servers, the information is more secure than more traditional data storage. Reliable cloud providers go to enormous lengths to protect their servers both physically and digitally. You can benefit from another company’s cyber-expertise and keep all your digital data safe.

Additionally, cloud computing is capable of so much storage and comes with features such as automatic backups and more. This is especially useful for secure document management. Your accounting firm will avoid computer crashes during tax season due to a full hard drive.

Increased flexibility

Cloud computing is a time-efficient option for working with clients because client information stored in the cloud is accessible from any computer anywhere with internet. That means you don’t have to be in your office to be able to help a client or team member with a case. For example, IRS forms can be uploaded and sent between you and your client from wherever you are.

User-friendly

Many new cloud applications are made to be more user friendly and more efficient than older, outdated software. Many accounting professionals have avoided using cloud computing because they do not have a tech-savvy background or they worry about the security of information in the cloud. You have no reason to worry because cloud computing is trusted and used by thousands of reputable businesses across the globe and is often intuitive to use.

Sources:

Hosting Tribunal: https://hostingtribunal.com/blog/cloud-computing-statistics/

Canopy: https://www.getcanopy.com/ebook/what-clients-expect-from-accountant-2020

Experience the cloud today

There are some real benefits to making the switch to cloud computing. It will make your life easier by saving you time and money. Plus, you will be able to meet clients’ needs more efficiently since the cloud is accessible from any computer anywhere with internet and no downloads are necessary. Fast, cost-efficient, secure—when it comes to listing the benefits of cloud computing, there’s no limit.

If you would like to get a taste of the time and cost savings benefits the cloud can offer, try a free trial of Canopy's services. You’ll see for yourself why so many accounting professionals are making the switch to cloud-based accounting software.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.