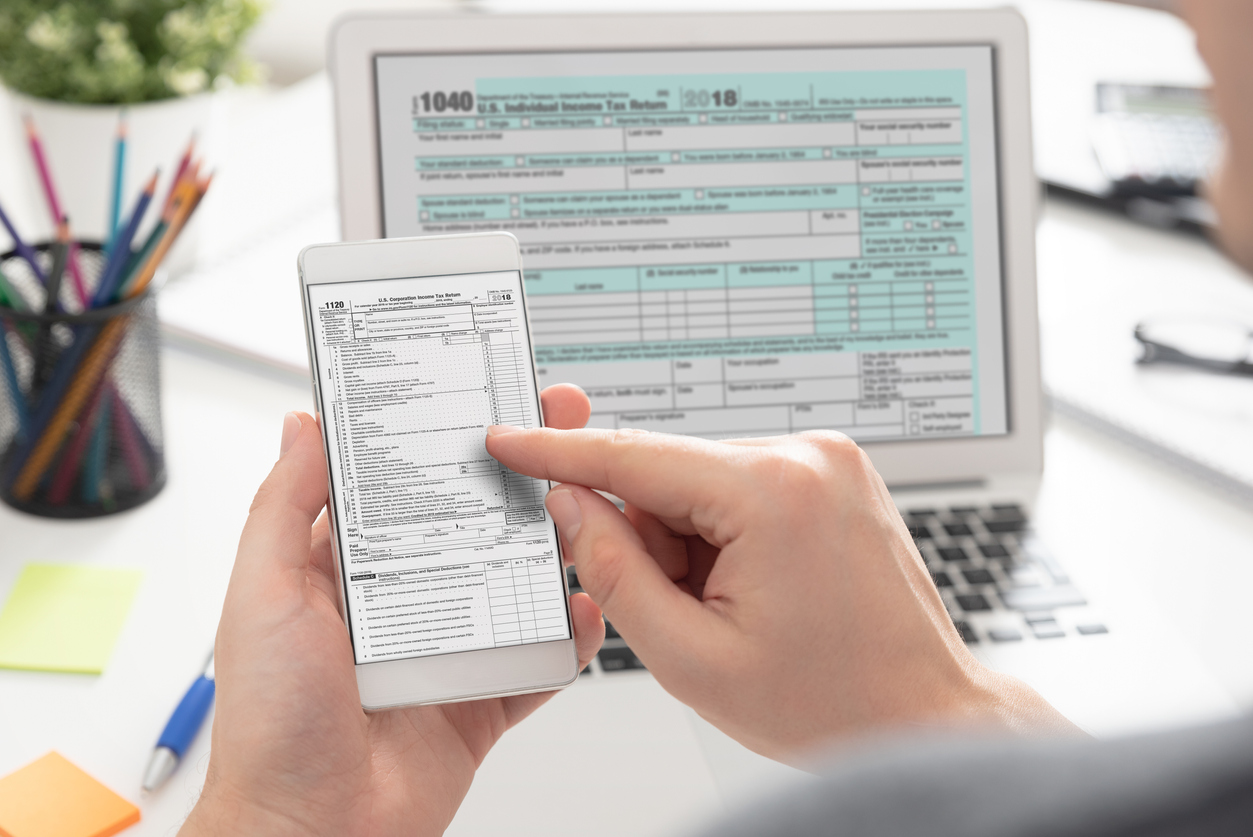

The IRS recently changed the format of tax transcripts for individuals to a redacted transcript. In an effort to safeguard taxpayer information from cybercriminals, all personally identifiable information (including social security numbers, account numbers, addresses, etc.) is now masked.

What’s visible on the transcript?

The new transcripts show the following:

- Last four digits of any social security number

- Last four digits of any employer identification number

- Last four digits of any account number

- Last four digits of any telephone number

- First four characters of the last name for any individual (unless the last name only has four letters)

- First four characters of a business name

- First six characters of a street address (including spaces)

- All money amounts

You can check out an example of a redacted transcript here.

What's a Customer File Number?

With these changes to transcripts, the IRS has also updated Form 4506-T and Form 4506T-EZ, Request for Transcript of Tax Return. Line 5b now asks for an optional Customer File Number that will be visible on a taxpayer’s transcript since full social security numbers are no longer visible. A Customer File Number is a 10-digit number created by the taxpayer or third party that allows the third party to match a transcript to the taxpayer. Customer File Numbers are primarily intended for third parties that request a high volume of transcripts.

Can I request an unmasked transcript?

If you need an unmasked Wage & Income transcript to prepare a client’s return, you may call the IRS and request one. The IRS will mail the transcript to your client.

How does this affect Canopy’s Transcripts Tool?

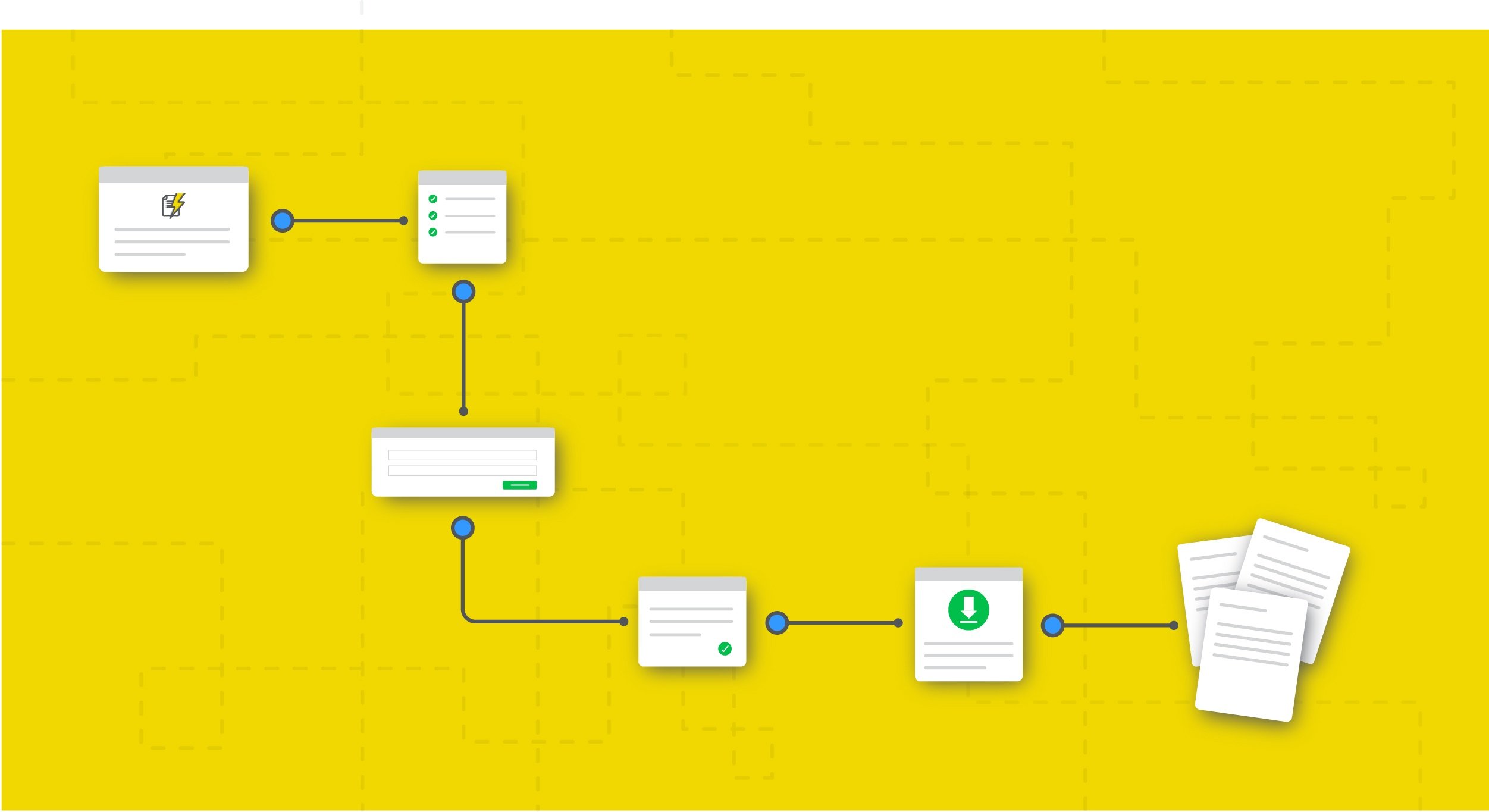

Your experience with Canopy’s Transcripts Tool will stay the same other than that the transcripts pulled within Canopy will now also be redacted, as our tool works via e-Services and is IRS compliant.

Adjusting to e-Services changes can be a hassle, but Canopy’s Transcripts Tool is still a breeze to use. Named 2018 Top New Tax Product by Accounting Today, our tool pulls every transcript related to your client in minutes and provides hundreds of calculations. Plus, you can try the trial for free. You can try it out for yourself here.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.