Free CPE Courses. Self-Study with Canopy.

Complete your credit requirements with Canopy, for free! Earn credits with unlimited, self-study video courses and webinars. Access a wide variety of highly-rated content taught by top-ranking thought leaders.

- Unlimited, Free and On-Demand CPE Classes. You won't find a more convenient CPE platform.

- Classes that aren't boring. Explore engaging classes from industry leaders, influencers and experts.

- Automatic certificate delivery. Certificates are immediately verified and delivered as soon as you complete a class.

CANOPY COURSES

Premiuim CPE & CE Credits

Canopy's catalogue of Free CPE & CE classes spans eleven categories, offering everything from tax law updates to business management tips and tricks. Explore exclusive and engaging classes from any of these categories:

- Accounting

- Auditing

- Business Management

- Business Management & Organization

- Communications and Marketing

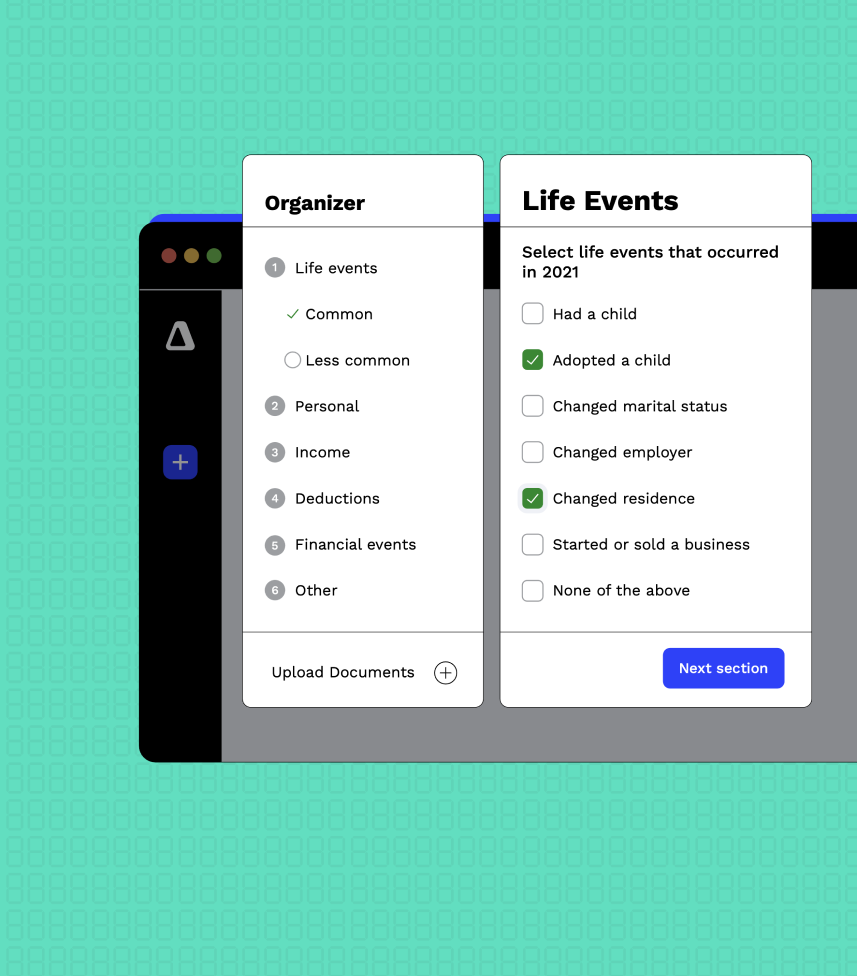

- Computer Software & Applications

- Ethics

- Finance

- Personal Development

- Personnel / Human Resources

- Taxes

Get Started with Canopy CPE

Sign up for free and select from hundreds of in-depth courses, taught by industry leaders and trusted professionals.

1. Sign up for free.

Canopy's CPE & CE platform is completely free! Just enter your details in our registration form to gain access to hundreds of free courses.

2. Select from hundreds of in-depth courses.

Say goodbye to boring CPE! Our creative courses are designed to answer the questions modern accountants actually have.

3. Get your certificate delivered, fast.

As soon as you complete your course, we'll deliver a verified Certificate of Completion to your Canopy account.

Everything to Know about Cybersecurity

And earn 2 free CPE credits while you're at it.

The 2023 Cybersecurity Update for Accountants

Learn everything you need to know about cybersecurity as an accountant. From the ethics, rules and legal requirements you need to know to top 5 cybersecurity risks for accountants - this course will cover it all.

This course is a continuation of Cyber Security – Part I - Why you Need to secure your small business against cyber threats, and we cover the next steps you can take to perform a self-assessment of your risks. We will cover areas of Physical Safeguards, Personnel Security, and Computer Systems & Information Security. Find the second part here.