The tax problems your clients bring to you can be a mess. The process you use to resolve them doesn’t have to be.

We can help resolve one of them.

Simplify Processes

There are too many items and processes to be able to just automatically know how to work on or respond to each of them. Fortunately, with Canopy, you don’t have to.

Utilize Templates

With pre-built workflows, letter templates, and more, you’ll find tax work a breeze. (Or at least breezier.)

Automate Calculations

For both client surveys, and calculation forms, Canopy will do the math on the backend for you.

We know that you and your clients work hard to avoid IRS cases, but when one occurs, Canopy can help to guide you through.

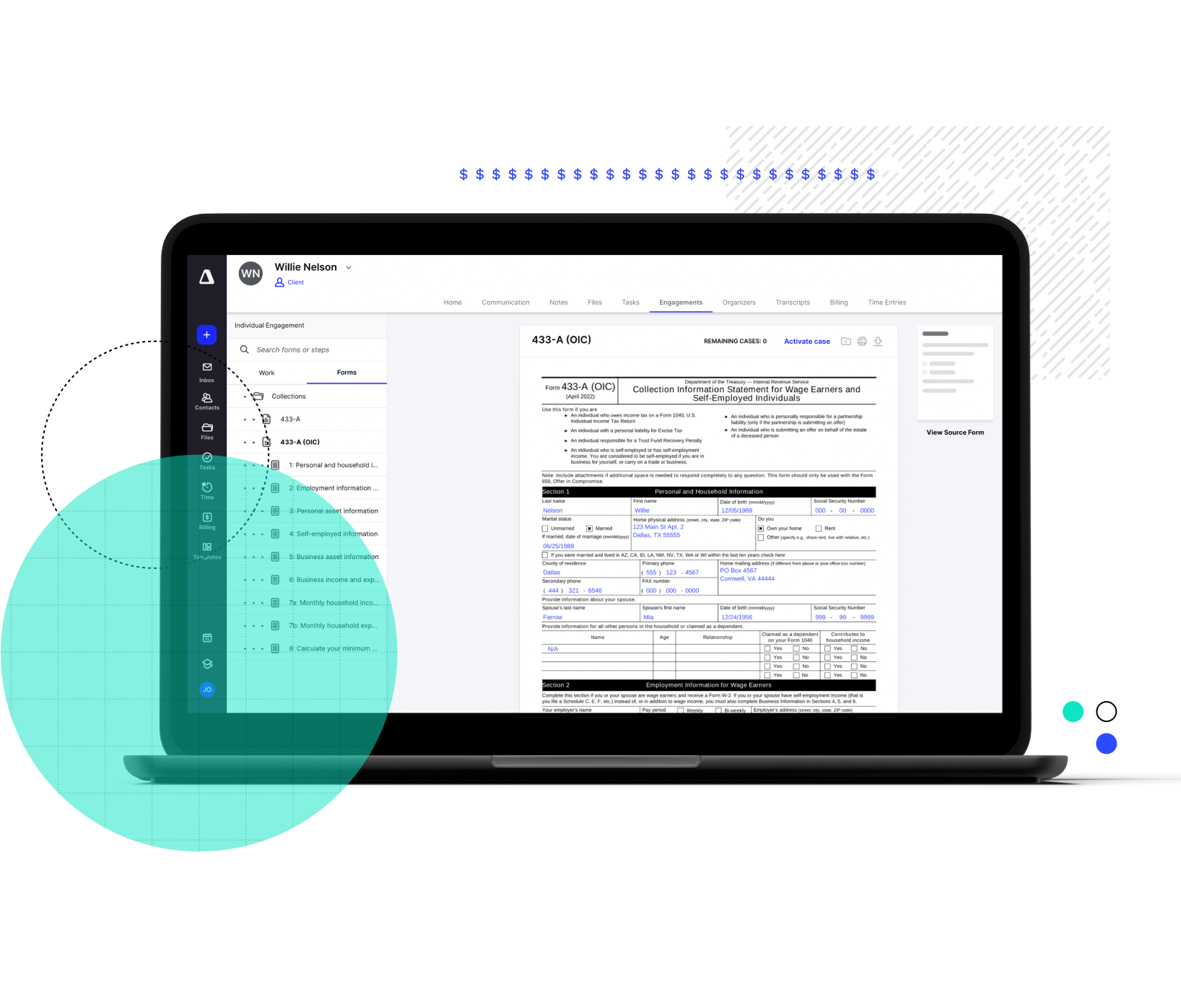

Your client fills out the Canopy survey you send them (via their client portal, another perk of having the Canopy Client Management platform). Canopy then asks you—the accountant—questions. Information from you and your client will then be auto-populated into the legal form. All that’s left for you to do is review and edit the form, if necessary. Finally, share it with your client in the client portal for them to eSign (if Document Management is purchased) and return to you. Then it’s ready to print and file with the IRS.

You can quickly make changes to a tax form, like adding an asset a client forgot to tell you about, and rest assured that Canopy will automatically update the associated collection calculations, saving you time. But it doesn’t stop there. Canopy will evaluate your client’s financial profile and recommend available courses of action for resolving their tax debt.

To get started, Canopy asks a series of questions about the client and based on the answers, we guide you to recommendations for how to resolve the issue.

Canopy gives you practically everything you need to know about each case type—including an overview of the case type, information on who to call at the IRS, script of talking points, and links to important or relevant IRS articles.

When we say that Canopy helps guide you through the process we mean it and include step-by-step guides. Each template is completely customizable to match your firm’s processes. And from each template, you can also easily link to any pulled transcripts for the client, make quick notes, and see associated files. We don’t want to say that resolving IRS cases is easy—but it’s definitely easier with Canopy.

Shelley Loughrin

/ Tampa Tax Relief

Canopy makes resolving a case simple with our letter generator, client requests, and financial questionnaire. Send your clients to your customizable client portal where they can quickly and easily respond, and automatically remind them in case they forget to respond.

Canopy offers custom and editable templates that allow you to send out engagement letters (or, really, any letter you want) to your clients to get your tax resolution cases started. Better yet the letters automatically fill in any information from your client’s record. Additionally, it highlights in red text the areas you need to complete or delete if not relevant to your client. And because Tax Resolution is integrated with Client Management, it’s easy to share with your client via their Client Portal. And have them eSign it if you’ve purchased Document Management.

Need your client to send you documentation? Send a client request. Need them to eSign a document (requires Document Management license)? Send them a client request and the process is seamless. Let's keep it simple and leave the rocket science to scientists, shall we?

Have a lot of questions or information you need to gather from your clients? It’s easy to send a client survey and have them fill out all that information directly in Canopy. Or you can fill it out on their behalf during a client meeting. The best part, this information is used to populate 433 series IRS forms.

Tax laws and agency procedures are complex and almost innumerable. Canopy helps simplify the work you do to help your clients be compliant. Once you’ve selected the type of case you’re working on for your client, you simply follow the recommended next steps that Canopy has built out (or you can build your own custom step-by-step template.)

Collections:

Installment agreements, offers-in-compromise, currently non collectible, liens, levies

Penalties:

Trust fund recovery, first-time penalty abatement, reasonable cause penalty abatement

Spousal Relief:

Innocent spouse relief, separation of liability or injured spouse allocation, equitable relief

Can’t find the answer you are looking for? Reach out to our support team.

Yes! We simplify the entire tax resolution process for accountants! With pre-filled forms, easy data collection via a simple client survey, and automatic payment plan calculations - tax resolution is quick and painless for you and your clients.

Of course. Canopy has the largest tax resolutions database. With 230 forms in our library (including every state's power of attorney and every federal collection form) – rest assured that if there's a form you need, Canopy likely already has it.

No. But once your documentation is processed with the IRS, you will be able to quickly and easily access Transcripts directly within Canopy (see the Transcripts & Notices page for more details).

Submit this form, and we will be in touch soon to give you a custom demo.

Set a time for one of our product specialists to give you a guided tour practice.