As a CPA, you know that your mandatory CPE credits can be earned by participating in a wide variety of courses, webinars, workshops, and conferences. Because summer and fall are slower seasons for tax professionals, now is the perfect time to earn CPE credit so you can hit the ground running when tax season starts. Today, we're sharing 10 great course options for continuing your education as a CPA. Every course listed meets NASBA and IRS requirements.

§199A Small Business Deduction Overview

Instructor: Tanya Baber

Type: Webinar, Self-Study

Credit Hours: 1

§199A is by far one of the most complex things to come out of the Tax Cuts and Jobs Act of 2017. If you are like most practitioners, you may be wondering what you’re supposed to do now that you have to figure it out for tax returns. In this course you’ll learn about who can use the passthrough deduction, the specific income limits associated with §199A, how to calculate and use Qualified Business Income (QBI), and more. This course is Part 1 of 3, so there’s more content to check out once you’ve completed it.

Audit Defense Strategies & Negotiating with the IRS

Instructor: Dan Pilla

Type: Webinar, Self-Study

Credit Hours: 1

Negotiating with the IRS takes a specific skill set and understanding to ensure you achieve the best outcome for your client. This course will help you learn the process the IRS follows for audits, where the burden of proof lies, how to ensure taxpayers are meeting IRS requirements, and more.

Responding to the Most Common IRS Notices

Instructor: Jeff McNeal

Type: Webinar, Self-Study

Credit Hours: 1

More than 200 million IRS notices are sent each year with hundreds of different types of penalties. Taught by a former Revenue Officer, this course will show you how to diagnose and respond to the three most common notices: CP2000, LT 11 (aka FND-1058), and CP523. You will also be given the tools to get them resolved in the most efficient way possible. By knowing what to do in the case of each of these notices, you can build trust with your current clients, keep them out of hot water, and save yourself future trouble.

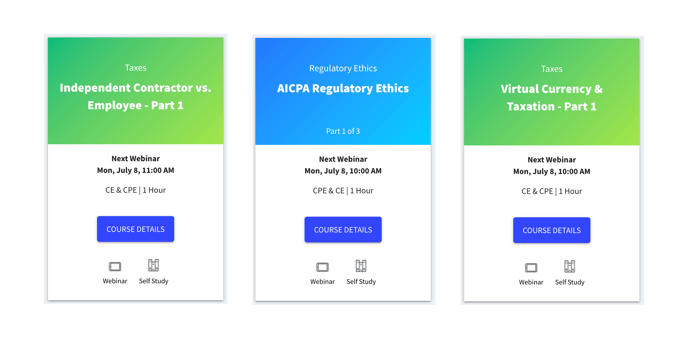

AICPA Regulatory Ethics

Instructor: Allison McLeod

Type: Webinar, Self-Study

Credit Hours: 1

This course goes over the first portion of the AICPA Code of Professional Conduct dealing with integrity, objectivity, and judgement. Through real-world examples, case studies, and scenarios, you’ll get a good idea of what it means to be ethical in performing job functions. Additionally, this course explores different ways that a professional could fall into compromising situations and practical ways to address conflicts of interest. This course is Part 1 of 4.

Independent Contractor vs. Employee

Instructor: Tanya Baber

Type: Webinar, Self-Study

Credit Hours: 1

Independent contractors can potentially save your clients money, but with increased IRS scrutiny, your clients could be at risk for penalties and liability. This course will help you fully understand the differences between an employee and an independent contractor, what the advantages and disadvantages of each classification are, and what statutory employees and contractors are. Take this course to develop the skills you need to keep your clients audit-ready and in compliance.

Virtual Currency & Taxation

Instructor: Amy Wall

Type: Webinar, Self-Study

Credit Hours: 1

Virtual currency is becoming more and more common, and with that increase in popularity, an underreporting issue is also growing. Tax professionals are going to be responsible for helping keep their clients in compliance. This course is intended to help you become savvy with tax issues and considerations surrounding virtual currency. You’ll learn the history of cryptocurrency including Bitcoin, Ethereum, and Litecoin, as well as the differences between cryptocurrency, digital currency, and virtual currency. This course is Part 1 of a comprehensive 3-part series.

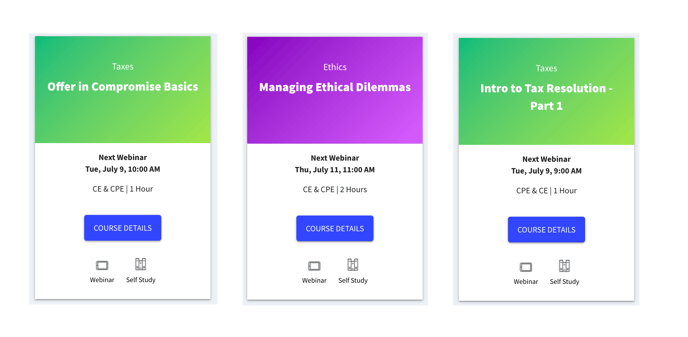

Offer in Compromise Basics

Instructor: Tanya Baber

Type: Webinar, Self-Study

Credit Hours: 1

This course is designed to help you become familiar with the IRS Offer in Compromise (OIC) program. You’ll learn about the pros and cons of an OIC, the qualifications for filing a processable offer, and the three different types of offers. This course also goes over the two current OIC payment options available and the proper calculation of the all-important Reasonable Collection Potential. This course is also Part 1 of a 3-part series.

Intro to Tax Resolution

Instructor: Tanya Baber

Type: Webinar, Self-Study

Credit Hours: 1

While many tax professionals understand basic concepts of tax resolution and even dabble in it from time to time, many don’t fully understand the complexities and nuances of representation. When it comes to tax resolution, what you don’t know can hurt you and your client. In this course you’ll learn about the authority granted by Circular 230, proper submission of IRS forms 2848 and 8821, and how to obtain and work with confidential taxpayer information. If you’ve always wanted to take tax representation to the next level, this course is for you.

Managing Ethical Dilemmas

Instructor: Robert E. McKenzie

Type: Webinar, Self-Study

Credit Hours: 2

Circular 230 has recently been revised and new duties and responsibilities have been imposed on practitioners who represent taxpayers before the IRS. Every practitioner needs to understand their duties to the tax system and to their client. This course will help you learn how to balance those duties, as well as help you understand what fees are unconscionable, what taxpayer confidences you may disclose to the IRS, and more.

Cyber Security

Instructor: Tanya Baber

Type: Webinar, Self-Study

Credit Hours: 2

Working with your clients’ financial information comes along with a lot of cybersecurity risk—especially in a day and age where phishing, malware, and ransomware run rampant. This course will help you understand the top five cybersecurity risks for accountants, the rules and legal requirements for safeguarding client information, and new IRS two-factor authentication security measures. After Part 1 and 2 of this course, you should better understand how to protect your clients’ information, as well as understand your legal obligations.

Ready to start taking online CPE courses? Sign up for Canopy Courses here—you’ll be able to take two credit hours for free.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.